Toggle Auto Insurance: Modern Car Coverage for All

We noticed that many auto insurance companies rely on outdated methods, much like a tan sedan with macramé seat covers driven only on Sundays. Inspired by our success with renters insurance, we set out to modernize auto coverage for today’s drivers. Our goal is to offer a smarter, more streamlined, convenient, and customizable experience, harnessing the power of the internet to help you save money with Toggle Auto Insurance.

Compare quotes from top providers

I’ve been reviewing auto insurance companies for a long time, so when I came across a company I hadn’t heard of before called Toggle, I was intrigued. It turns out Toggle is Farmer’s latest brand, and many 21st Century customers are being migrated to it. For everyone else, Toggle is available in just 14 states: Arizona, California, Colorado, Georgia, Illinois, Indiana, Missouri, Ohio, Oregon, South Carolina, Tennessee, Texas, Virginia, and Wisconsin. The company has no local agents. Rather, the entire process, from buying to managing your policy, takes place on its website or via its call center. Is it the right insurance company for you? Let’s decide together.

When it comes to insurance, there’s no one-size-fits-all. If you’re not sure where to start, check out our top picks for the best auto insurance companies.

Toggle Auto Insurance Reviews: Pros and Cons Overview

Pros

-

Quick online quotes

-

Discounts for bundling auto and renters insurance

-

Lower than average annual premiums

Cons

-

Only available in 14 states

-

Does not offer non-owner insurance, rideshare coverage, or SR-22s

Toggle Auto Insurance Reviews: Who Is It Best For?

Toggle Auto Insurance Reviews: Pricing Overview

Compare Toggle Rates

| Company | Average annual premium for full coverage | Average annual premium for minimum coverage |

|---|---|---|

| National Average | $2,399 | $635 |

| AAA | $3,014 | $1,056 |

| Allstate | $2,605 | $840 |

| American Family | $1,936 | $604 |

| Erie | $1,647 | $581 |

| Farmers | $2,979 | $1,002 |

| GEICO | $1,731 | $517 |

| Nationwide | $1,808 | $718 |

| Progressive | $1,960 | $638 |

| State Farm | $2,167 | $674 |

| Toggle | $3,312 | $1,524 |

| USAA | $1,407 | $417 |

Get Toggle Auto Insurance: Ways to Save on Your Policy

You can also save with Toggle Auto Insurance by being a homeowner, owning a car with an Automatic Emergency Braking system, or bundling your auto and renters policy.

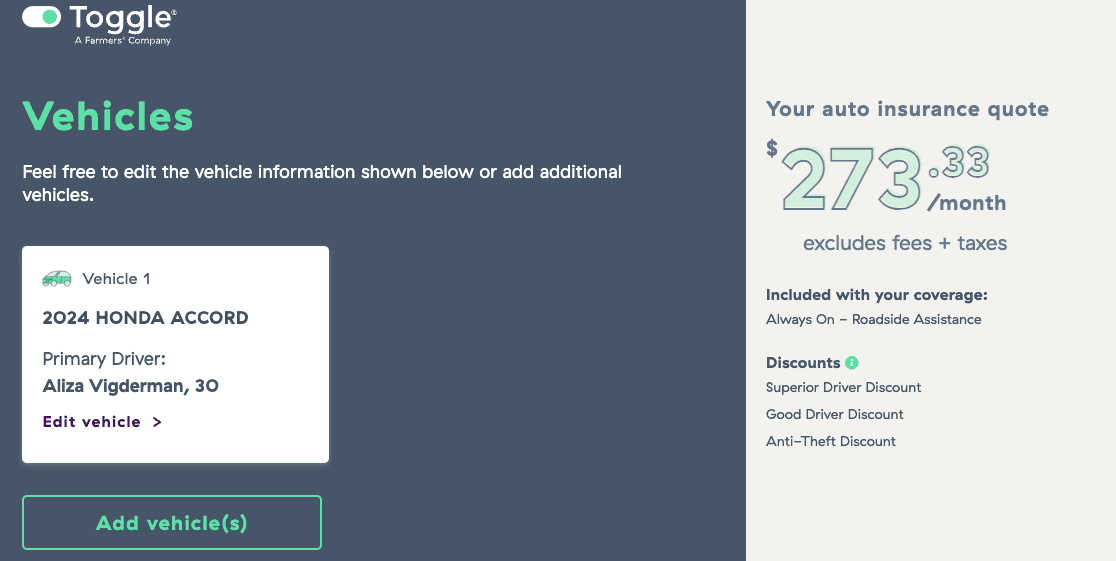

Toggle Auto Insurance Quote: My Quote Experience

This was probably the quickest quote process I’ve ever seen. Toggle Auto Insurance automatically picked up my driving history from my name and address, and within seconds I was filling in my vehicle and getting a quote. Once I had the quote, I could adjust limits and add coverages to see how it would affect the price. With Toggle Auto Insurance, I could also call a number, although it’s clear that the website directs most people to get quotes online. Still, that’s an option if you don’t want to go through the computer.

However, if you prefer talking to an actual human in person, I would check out Farmers, Toggle Auto Insurance’s more traditional parent company, which has local offices throughout the country.

Toggle Auto Insurance: Coverage and Options Overview

So what’s missing? Toggle Auto Insurance doesn’t offer non-owner insurance, SR-22s, or rideshare coverage. Non-owner insurance is a good idea if you frequently borrow or rent cars, including carshares like Zipcar. An SR-22 is a form required after certain serious driving offenses, like DUIs, proving that drivers meet state-mandated insurance requirements. Rideshare coverage is essential for drivers who work with companies like Uber or Lyft to cover gaps in their personal auto policies. If you need any of these specialized coverages, you’ll need to explore other insurers that cater to those specific needs.

Note that Toggle Auto Insurance is only available in 14 states, as of writing. These are:

- Arizona

- California

- Colorado

- Georgia

- Illinois

- Indiana

- Missouri

- Ohio

- Oregon

- South Carolina

- Tennessee

- Texas

- Virginia

- Wisconsin

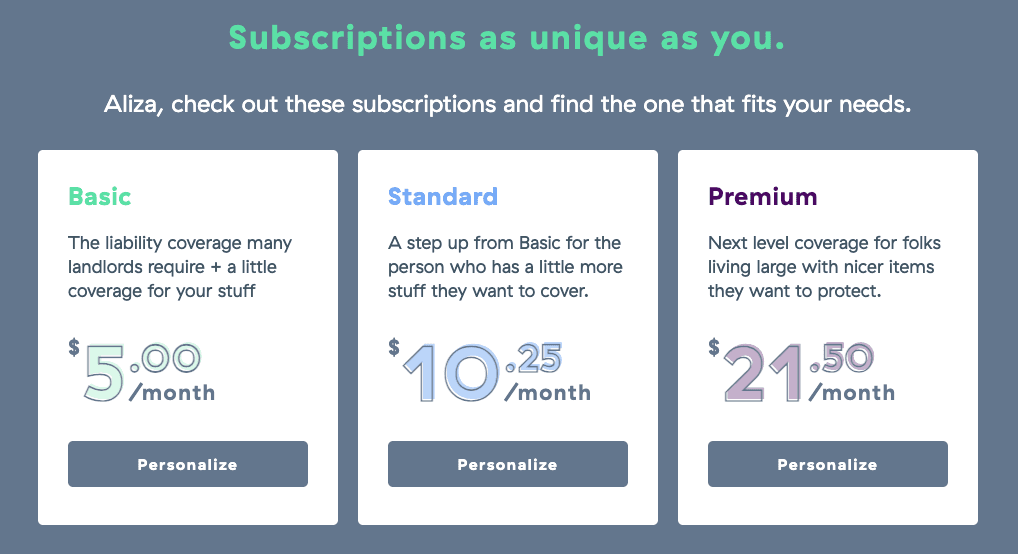

Renters insurance is much cheaper than auto insurance; I got quoted for as little as $5 a month.

Let’s take the lowest-tier plan, which includes a deductible of up to $500 and a liability limit of $100,000. I could have customized my policy, adding coverage for:

- Up to $10,000 for technology, jewelry and fashion, cameras, art supplies, and other creative tools, active gear and equipment, and collectibles

- Up to $20,000 for furniture and appliances

In general, I think it makes sense to increase your coverage above the minimum. It usually doesn’t add too much to your premiums, and in the event of a worst case scenario, like a fire, the expense of replacing your belongings adds up quickly.

Once I chose the limits I wanted for each category, I had a few add-ons to choose from:

- Identity theft: While not technically renters insurance, identity theft monitoring will let you know if your personal data was leaked.

- Pets: If you have a pet, this coverage would go to any damages they make to your rental home.

- Replacement: Some people may prefer to replace rather than repair items.

- Side hustle: Didn’t think Toggle was targeted at millennials before? You will now. If you’re part of the majority of the country that has a side hustle, you can get insurance for your business expenses like a camera or other equipment.

- Significant other: Add your spouse or partner to your renters insurance, whether you’re married or just live in the same house, for free.

- Temporary living: If you need to stay somewhere else while you’re experiencing a covered loss, this coverage will contribute to your hotel bill.

DID YOU KNOW?

Toggle Auto Insurance Login: Customer Satisfaction Insights

| Category | Toggle/Farmers |

|---|---|

| J.D. Power Customer Satisfaction (Farmers) | 617 out of 1,000 in California (average was 637)

624 out of 1,000 in Texas (average was 645)2 |

| AM Best (Toggle) | A (excellent)3 |

| National Association of Insurance Commissioners (Toggle) | 8.91 (nearly 9 times more complaints than expected for a company of its size)4 |

| Moody’s (Farmers) | Stable outlook5 |

| Standard and Poor’s (Farmers) | A |

Toggle Auto Insurance Login App: Customer Support Overview

| Source | Toggle/Farmers Score |

|---|---|

| CRASH Network Insurer Report Card | C-, 78th out of 88 insurers6 |

| J.D. Power Claims Satisfaction Study | 706 out of 1,000 (above average)7 |

Toggle Auto Insurance Login App – Web Experience Without the App

How We Evaluate Auto Insurance — Toggle Auto Insurance Phone Number and More

When reviewing Toggle Auto Insurance, we consider multiple important factors to ensure a reliable experience for drivers:

- Coverages and pricing: We expect comprehensive offerings, including

essentials like liability and collision, along with extras such as roadside assistance and

rental coverage. We also compare Toggle’s pricing against other providers to assess

average rates.

- Customer satisfaction: We look at feedback from sources like J.D. Power and

the Better Business Bureau to determine how satisfied policyholders are with Toggle’s

service.

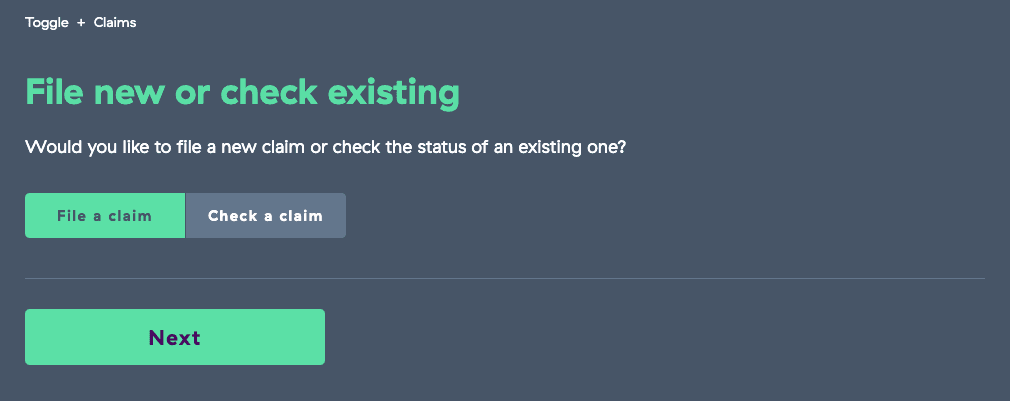

- Claims process: A top insurer should allow you to file claims easily

— through its website, app, and by phone. Toggle provides claim submission online, but

timely responses and customer support quality are also evaluated.

- Financial strength: We review ratings from agencies like AM Best and

Moody’s to ensure the company is financially stable enough to cover claims

reliably.

Digital tools and accessibility: We assess how easy it is to manage your policy through Toggle’s online tools, including account access, digital ID cards, and claims. While Toggle lacks a mobile app, features like website-based management and access to the toggle auto insurance phone number help customers stay connected.

Frequently Asked Questions

How do I use the Toggle Auto Insurance login app?

To access your policy on the go, download the Toggle Auto Insurance login app on your smartphone. It allows you to manage coverages, make payments, and file claims easily. If you're looking for a cost-effective option, the Toggle Auto Insurance login app free version is available with basic features.

How can I get a Toggle Auto Insurance quote online?

You can get Toggle Auto Insurance quotes instantly by visiting the official website. Just enter your vehicle and driver information to receive a personalized Toggle Auto Insurance quote in minutes.

What is the Toggle Auto Insurance phone number for customer support?

If you need help with your policy or claim, you can contact customer service via the official Toggle Auto Insurance phone number, which is listed on their website. Representatives are available to assist with billing, login issues, and coverage questions.

Is there a separate Toggle Auto Insurance login California drivers?

Yes, California residents can access their accounts through the dedicated Toggle Auto Insurance login California portal. This ensures compliance with state-specific insurance requirements and makes managing your policy easy and secure.